Condo purchase - need referral for realtor

Last activity 09 February 2020 by OceanBeach92107

Subscribe to the topic

Post new topic

Articles to help you in your expat project in Da Nang

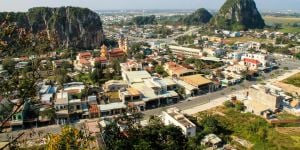

Accommodation in Da Nang

Accommodation in Da NangDa Nang's real estate market has experienced accelerated growth over the past few years as the population ...

How can I rent the most suitable accommodation in Da Nang?

How can I rent the most suitable accommodation in Da Nang?I find the expats who want to make a trip to another country have meet many difficulity.

Accommodation in Vietnam

Accommodation in VietnamIf you're jetting off to Asia's beloved S-shaped nation, take care of booking the best accommodation ...

Buying property in Vietnam

Buying property in VietnamIf you are planning on staying in Vietnam for a significant amount of time, buying a condo or getting involved in ...

Accommodation in Hai Phong

Accommodation in Hai PhongHai Phong's real estate market has been developing rapidly in recent years. Expats from around the world have ...

Working in Da Nang

Working in Da NangDa Nang is pivotal to the coastal development and central security of Vietnam. The primary industrial products in ...

Getting married in Vietnam

Getting married in VietnamHave you met that perfect someone who you want to spend the rest of your life with? Luckily, getting married in ...

Working in Vietnam

Working in VietnamAnyone thinking about working in Vietnam is in for a treat. Compared to many Western countries, Vietnam's ...